WeatherWise Signals for Finance

Exclusive, AI-powered weather intelligence that turns raw atmospheric data into actionable trading signals.

Get an edge with daily insights

Better entries, cleaner exits, fewer surprises.

Anticipate demand shifts and market impacts with better‑than‑market weather insights. Translate weather volatility into conviction, not noise.

Get ahead of competitors in weather‑sensitive trades with proprietary, AI‑enhanced signals.

Sharpen hedging strategies and exposure management using more precise, forward‑looking data.

Multi‑Layered Weather Data

WeatherWise Signals delivers exclusive, AI‑powered weather intelligence that transforms raw atmospheric data into actionable trading signals. Covering energy, agriculture, shipping, and commodities, even small forecasting advantages can drive outsized gains — especially in weather‑sensitive markets where timing and precision matter most.

We fuse satellite observations, ground sensors, operational disruptions, insurance exposures, and long‑term climate models into a single signal layer — then align it to your instruments. That means you see risks and opportunities before they ripple through public data streams, enabling faster entries, cleaner exits, and higher‑confidence positions.

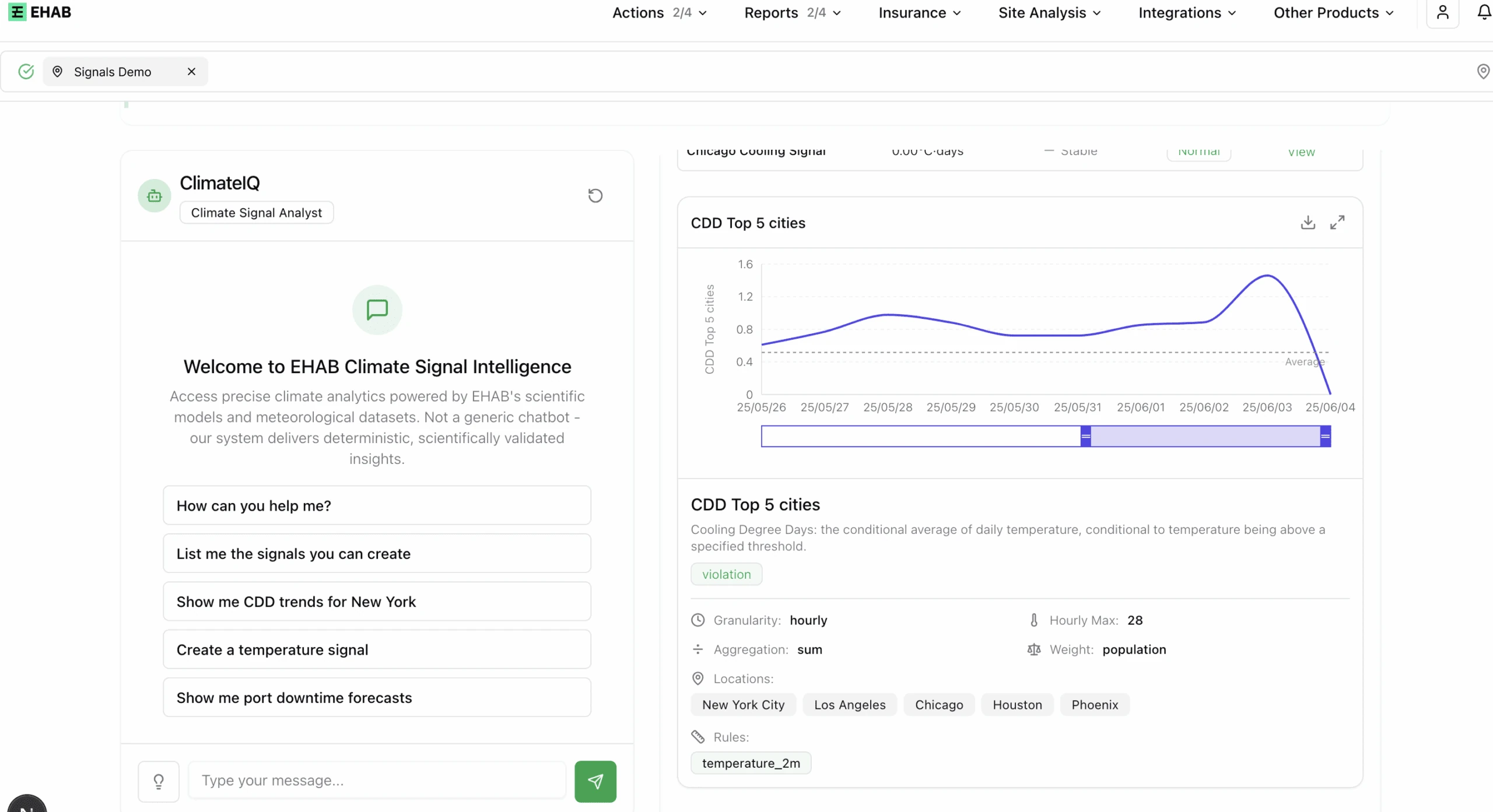

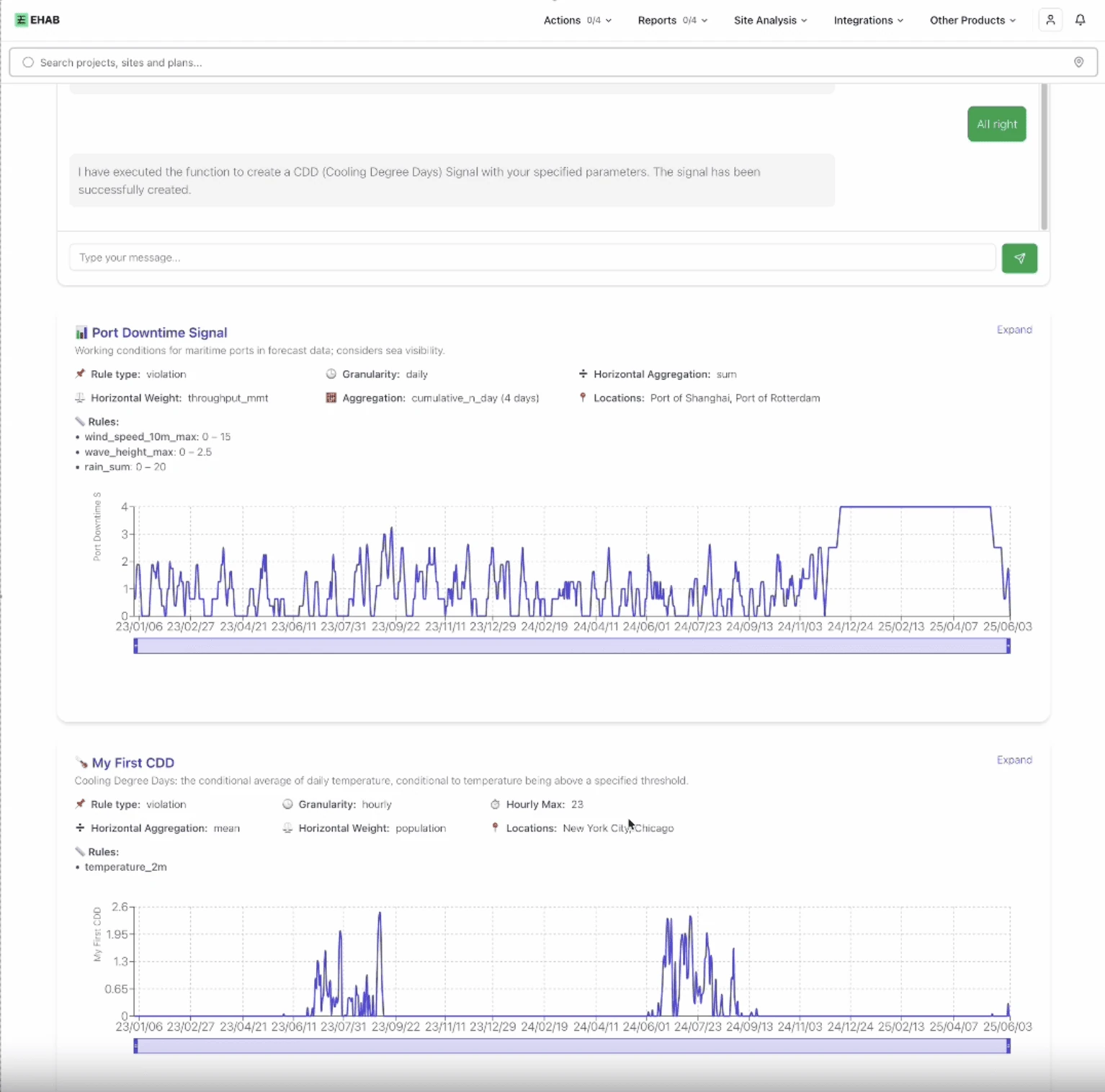

Rapidly create bespoke signals

Add your locations

Describe in natural language the areas the signal should include.

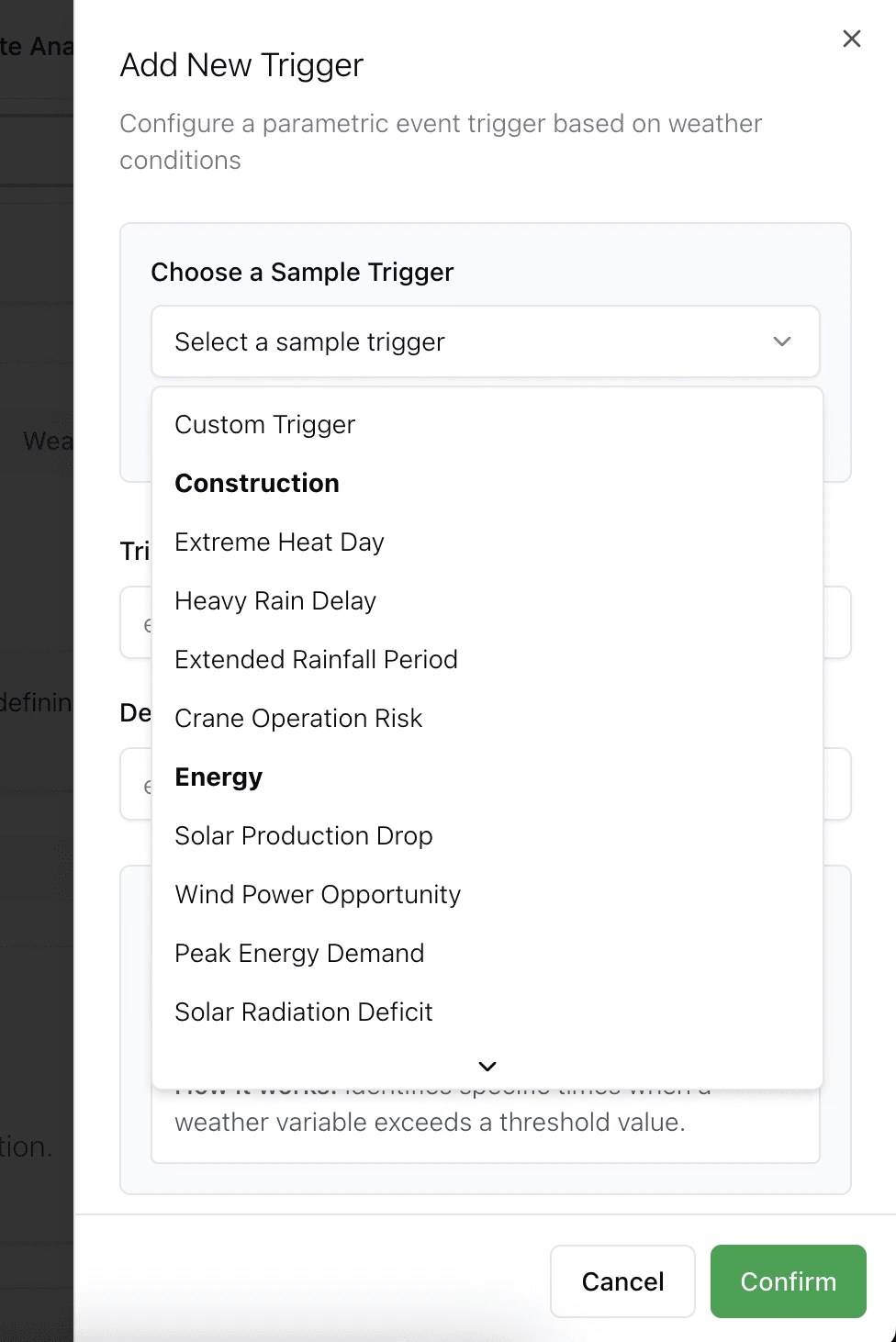

Input risk thresholds

Tell the AI what weather types influence the asset and the impact.

Confirm structure

Setup simple warnings for a breach or more advanced percentage differences.

Collective Weather Intelligence

Exclusive Operational Data▾

Continuous Learning AI▾

Stronger With Every User▾

Transform your trading — get your Data Pack today

Weather uncertainty is dragging performance. Get ahead with best‑in‑class, AI‑driven weather signals.

Get Data PackWhat types of weather signals can I access with WeatherWise Signals?▾

How are WeatherWise Signals different from public weather data?▾

How can weather signals improve my trading strategies?▾

Can I integrate WeatherWise Signals into my quant‑models or dashboards?▾

Who uses WeatherWise Signals today?▾

Latest from the blog

View all →Contact us

Want access or have a question? Drop your details and we’ll get back to you.